premium financing life insurance illustrations

Life Insurance Premium financing is a special asset based lending program available to the affluent marketplace for funding of premium payments for life insurance for estate planning charitable giving or business planning needs. However the idea of liquidating high-yielding investments in order to pay the premiums of a life insurance policy may not be an appealing.

5 Ways To Ask For Financial Help From Friends And Family Never The Right Word Illustration Vector Illustration Business Stock Images

To create a life insurance illustration the agent plugs many different variables into a software program developed by the insurer.

. With borrowing you can afford to buy 3m of life cover 5 x 600000. The bank loan pays the life insurance premiums for a defined period of time and then the policy becomes paid up no more premiums. Premium financing is a tool a way for the affluent client to buy the insurance policy.

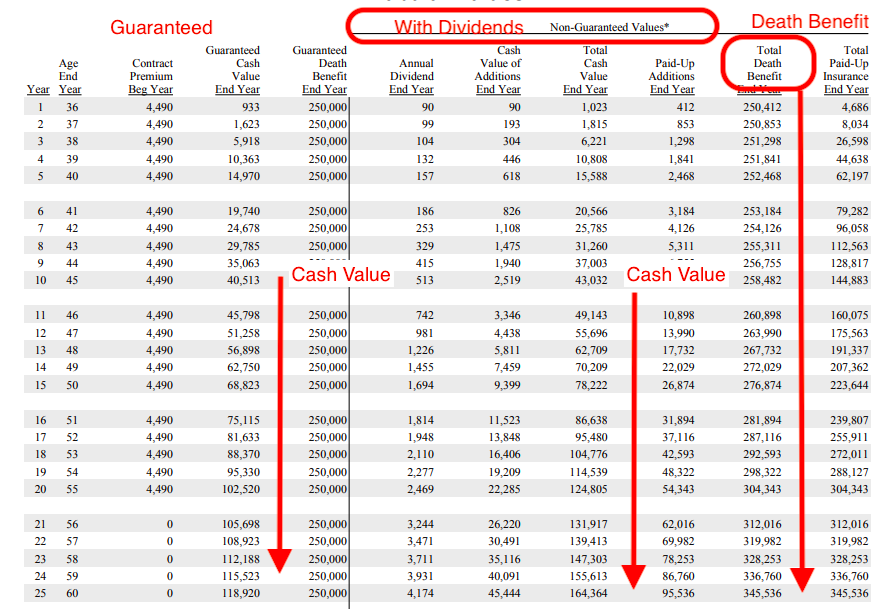

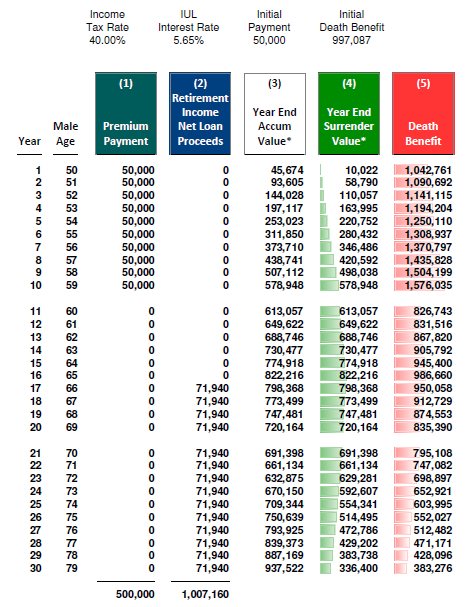

Premium finance loans are now always recourse loans. Review the policy illustration below for the details Death Benefit Option A Level. Insurance companies also may offer premium finance programs for their own insurance products.

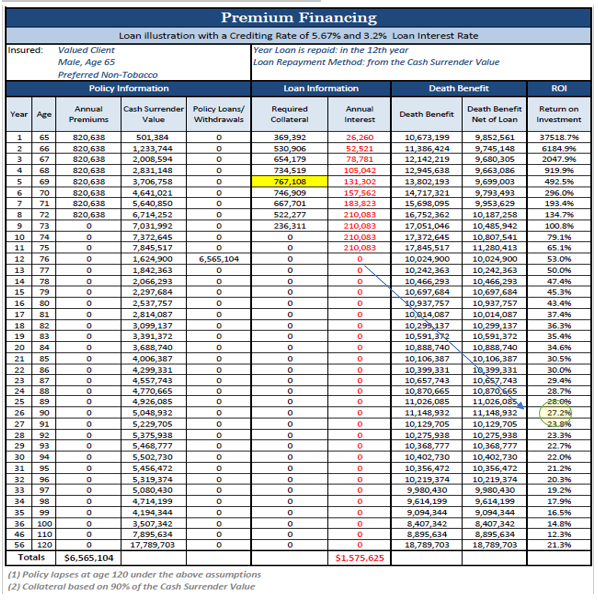

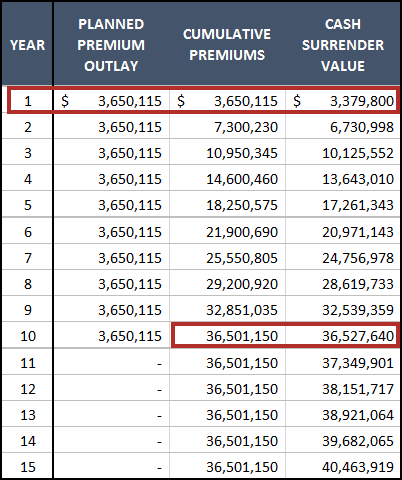

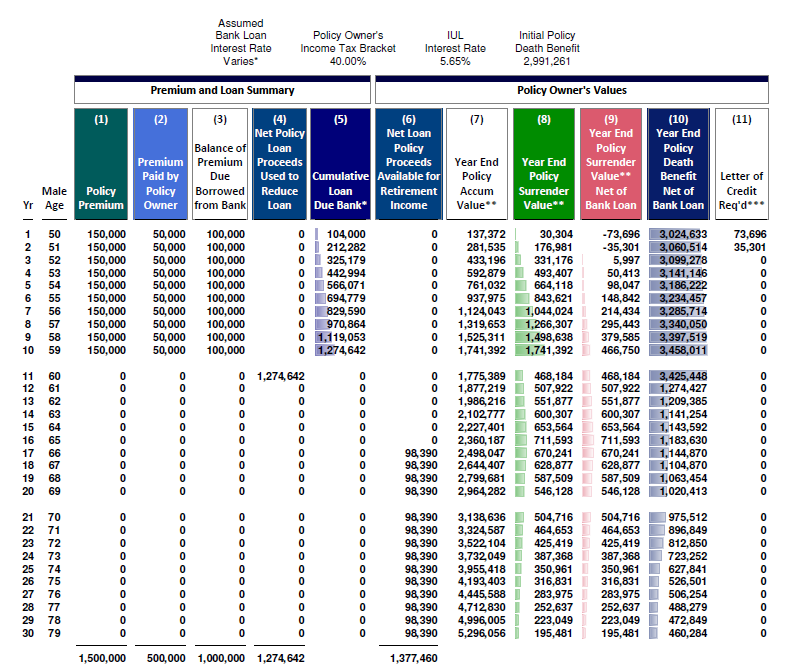

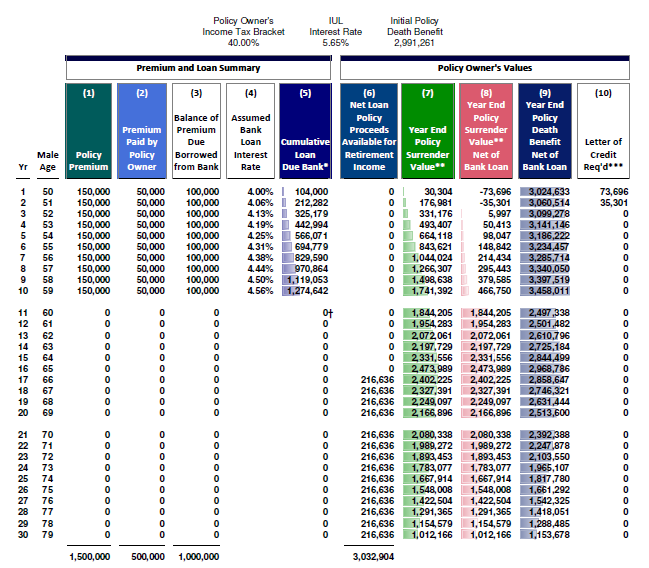

Through premium finance affluent individuals and business are now able to acquire as much life insurance as they qualify for to solve estate planning key-man charitable endowment loss protection and other financial planning needs utilizing the most favorable financing methods available at the most favorable rates. The premium finance company will take care of the premium payment due to the insurance carrier. Life Insurance Supplemental Illustration Leveraging Assets with Life Insurance and Premium Financing Purchasing life insurance is an ideal way to help you provide a legacy to your family or favorite charity.

Life Insurance Premium financing is a way to fund life insurance with a bank loan. As these refer to premium finance life insurance arrangements the terms have additional meaning. Thats an extra 24m of life cover.

You invest 200000 and finance the remaining 800000 giving you total life cover purchasing power of 1m. There are 3 reasons to consider financing a life insurance premium. What should become readily apparent is that the life.

Needs a substantial amount of insurance for estate-planning wealth accumulation liquidity at death asset protection or business. Life Insurance Premium Financing For many investors the primary purpose of life insurance is to provide financial protection to surviving spouses children and significant others. The borrower or insured in turn makes payments to the premium.

Death Benefit Qualification Test. It is important to note that the renewal. Premium Financing This System illustrates third-party financed life insurance owned by an individual a company or an irrevocable life insurance trust using any policy form desired.

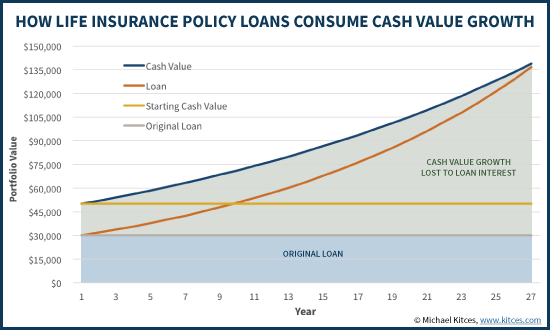

However if the policy performs more poorly than illustrated there is the risk. Premium Financing Life Insurance Assumptions AG 49 SP Index and LIBOR This is an Index Universal Life IUL product whose crediting rate at the time it was run was 567. Premium financed life insurance is most often illustrated with funds being borrowed continuously from a 3rd-party lender for at least 11-20 years before any sort of exit strategy is illustrated.

Insurance premium financing is similar to other types of loans. Premium Financing for Life Insurance. However if a policy outperforms these rates a premium financed life insurance illustration is capped at AG49 rates which can skew the potential outcomes.

For agent use only. Life Cover With Premium Finance. Not for public distribution.

There are even those that buy a policy but choose not to finance. The Market Section 3. The strategy allows a high net-worth individual who has a need for permanent life insurance to use.

This works out to be 3040month comprising 1040month guaranteed and 2000month non-guaranteed illustrated at an investment return of 425 from the start of year three. Only those clients that can write a check to pay the premium are suitable to using premium financing. The Life Insurance Illustrations Issues A Working Group created in 2016 is charged to explore how the narrative summary required by Section 7B of the Life Insurance Illustrations Model Regulation 582 and the policy summary required by Section 5A2 of the Life Insurance.

Simply it is the maximum crediting rate allowed based on the Actuarial Guideline 49 AG49 for short. Premium financing is typically provided by a premium finance company to an individual who seeks to obtain life insurance without the outlay of a large amount of personal funds to pay premiums. Typically you will use your life insurance to.

It is not a way for a policy to be sold to someone who cant afford the premiums. Assumes a 415 crediting rate and current charges. Instead of making payments directly to the insurance carrier the insured will work with a premium finance company.

It also includes an illustration module in which the income tax on an executive bonus used to purchase life insurance is funded via third-party financing. The pure premium financing model allows for direct comparisons of the economics of a life insurance policy funded out of pocket and a premium financing arrangement in a static universe which is the way the life insurance illustration almost always projects policy values. Premium financing can be an attractive option to anyone who.

However when life insurance is integrated with a well-thought-out estate plan the benefits can multiply. Thats 5x the life cover by financing your premium. The annuity plan will then start paying a monthly income to Tom at the end of the second policy year at a projected rate of 3648 of the net single premium of 1000000.

This is in stark contrast to the fact that most premium financing arrangements start with an initial loan term of only 3-5 years. Premium Finance Premium finance is a strategy used by wealthy individuals and business owners to finance premiums for large life insurance policies. Some of these variables will include your age health rating and.

Funds are provided by an independent lender to support current and future life. AIG Life Brokerage For Agent Training Only Not For Use With The Public The Process-Producer presents product and premium financing illustrations to the client-Life. One common use of life insurance is for estate tax liquidity.

But what does that really mean. What is Premium Financing.

.png?width=300&name=Inline%20Blog%20Images%20(27).png)

Creating Life Insurance Illustrations

How To Breakdown A Life Insurance Illustration Sample Illustration

By Ronald Mccloud Insurance Ads City New England

Leveraging Life Insurance A Guide To Premium Finance

What Are Paid Up Additions Pua In Life Insurance

Dreams And Uncertainty Http Www 21articles Com Article 1336 How To Embrace Uncertainty In The Pursuit Of A Permanent Life Insurance Life Insurance Insurance

Saudi Arabia Health Insurance Market Industry Trends Share Size Growth Opportunity And Foreca Buy Health Insurance Health Insurance Health Insurance Plans

Small Business Loans Small Business Loans Business Loans Investment Services

2021 Ultimate Guide To Premium Financed Life Insurance Banking Truths

Life Insurance Loans A Risky Way To Bank On Yourself

4 In 1 Insurance Concept Illustrations Vector Character Design Illustration Concept

Premium Financing Life Insurance What Can Go Wrong Agency One

Creating Life Insurance Illustrations

Premium Financing Illustration Life Insurance Planning For High Net Worth Families And Business Owners

A Rational Approach To Premium Financing Agency One

A Rational Approach To Premium Financing Agency One

Illustartion Of A Man At The Bank Premium Image By Rawpixel Com Kids Savings Account Best Savings Account Savings Account

A Rational Approach To Premium Financing Agency One

Premium Vector Flat Illustration Of Secure Yourself And Self Protection With Guaranteed Health Insurance Flat Illustration Cloud Illustration Vector Design